7 quick facts you need to know about equipment finance in 2022

Published

After 30 years of financing equipment in all manner of civil industries, we thought we’d share a few facts to assist business owners in getting the best outcomes on equipment purchases & finance in 2022.

1) Interest rates can vary by as much as 2% so it pays to shop around.

Unlike home loans, interest rates on equipment finance are open to competition between Banks and Finance Companies, so it pays to shop around or use a finance broker who will save you the time & will do it for you.

A 2% interest rate saving on a $300,000 loan over five years will save you over $330 a month ($20,000 over the entire term)

2) Spreading your equipment debt over a number of financiers instead of your bank can pay big dividends.

Often your bank will have a mortgage over your business, known as General Security Agreement (GSA) & they will most likely consider any exposure they have on equipment finance when looking to whether or not they would provide additional working capital facilities to fund your cash flow as your business grows. We see all too often banks refusing to provide increased home loans or additional overdraft limits, simply due to the level of exposure you have on equipment finance.

Furthermore, if you want to change banks, the departing bank will typically want to see you pay out all equipment loans prior to releasing the other securities required by the incoming bank. Being forced to pay out existing equipment loans incurs a penalty on early discharge (which you would not have to do if your equipment finance was with another provider).

Spreading your equipment finance across a broad base of lenders, not only creates competition between those lenders to ensure you get the right rates and the right terms, you’re also building a broad base of support of lenders who will typically continue to provide additional finance for your growing fleet of machines.

Spreading debt =

- More competitive rates & terms for you

- You’re building a broad base of support lenders to provide additional finance

- A quicker & more cost effective way of growing your fleet of machines

3) Finance under $1million can be completed without financials.

A large portion of finance under $1 million can be arranged these days without the need for you to provide financials and without any increase in the interest-rates. This is often known as Low Doc, Matrix, Easy Upgrade Products.

4) Used equipment is as easy to finance as new equipment.

Quality used equipment (purchased at auction or through a dealer) is often a viable alternative to new especially in this current environment where supply of new equipment has significant delays in delivery.

5) Private sales of used equipment can easily be financed.

Competitive equipment finance is easily available where the used equipment is being purchased from a Private Vendor. These private sale equipment finance arrangements do need a couple of extra steps performed such as an inspection of the goods and a more rigorous ownership check to ensure clear title is passed onto the financier. This is a simple task for a skilled finance broker, and they will do all the necessary work. (Chloe condensed this to below as a call out instead?)

Private sales require extra steps such as inspection of goods & ownerships checks. Using a skilled broker means they will complete these steps for you.

6) You can take advantage of a 100% tax write off on new or used equipment

The next 15 months is a window for you to obtain a 100% tax write off on any new or used equipment for companies with a turnover less than $50 million. The only condition is the equipment is installed and ready for use prior to June 30, 2023. This 100% write off is available even where the equipment is financed PROVIDED the loan is a Chattel Mortgage or Commercial Hire Purchase (CHP). It is NOT available if the equipment if financed via a Lease or Rent to Buy (where the purchase element is after June 30 2023). This is a once in a generation opportunity for companies to expand whilst minimising any tax liabilities on profitable trading through that period.

7) You have the ability to claim a 100% tax write off on your existing fleet

Although non-finance related, any company with a turnover of less than $10 million has an ability to claim a full 100% tax write off on their existing fleet (provided they are using the simplified tax system). The loss created can be carried back to prior years as far back as 2019 to obtain a tax refund on any tax paid during that term. In the event you still have tax losses after that tax carry back, you can carry those losses forward to offset future years trading profits.

Looking to secure equipment finance?

Use our equipment finance calculator to calculate your estimated payments, or speak to one of our finance experts to discover the equipment financing options best suited for you.

More News

How Access to Multiple Lenders Fuels Your Business Growth: Why One Bank Isn’t Your Only Option | Finlease

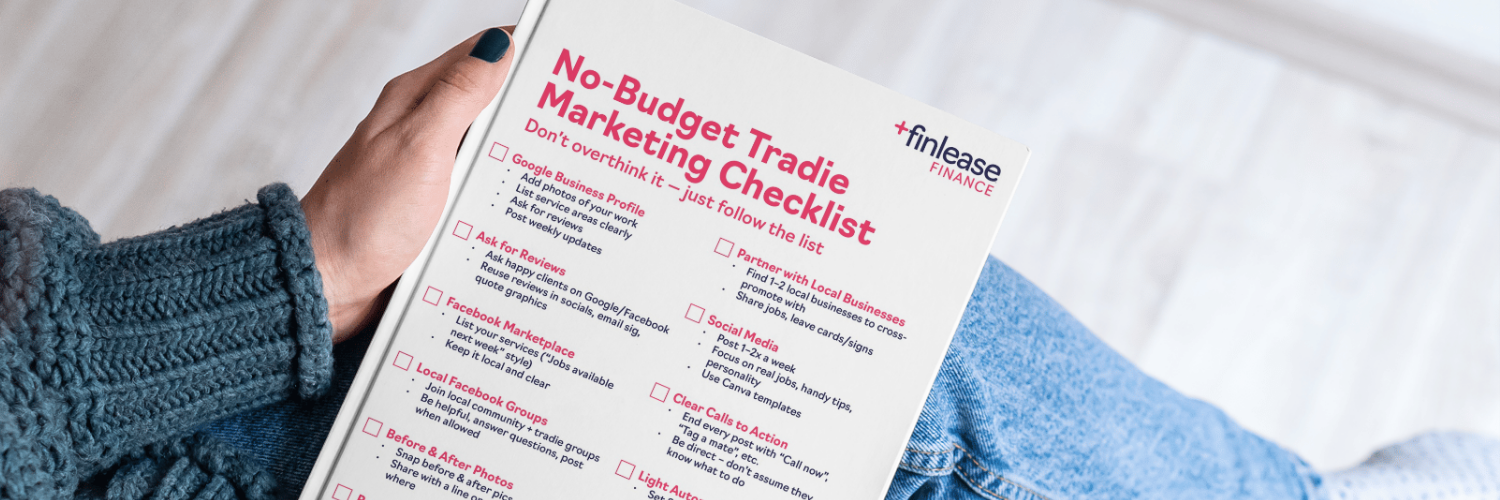

Marketing Ideas for Tradies With No Budget