Has the royal commission into banking had an effect on Equipment finance?

Published

The short answer is not really for those “in the know” or “well prepared”.

To give more detail on this answer the following is relevant.

Equipment Finance up to $500,000:-

Most equipment finance up to $500,000 is now automatically approved on a fast track system without the need for financial information and purely based on 3 simple criteria:-

New and used equipment up to $150,000 being vehicles and acceptable equipment is approved where the business has been operating for 2 years, has a clean credit history and the principal is a property owner. (20% deposit where not a property owner)

This amount increases on the same criteria up to $500,000 where the new debt replaces an existing finance commitment and the new payments are no greater than 125% of the prior loan which is about to or has just concluded.

This style of matrix or behavioural lending is now accounting for a significant amount of equipment finance and is very quickly arranged.

Equipment finance over $500,000:-

For individual requirements over $500,000 (or which don’t fit the matrix policies) traditional finance assessments need to be done.

This is the way traditional equipment finance has been done for 30 years and still is for larger assets or bulk limits.

In this space, the royal commission has had some effect in that the lenders are a little more cautious or more detailed in their assessment or to put it another way have increased paranoia that they may be seen later to have “got it wrong”. Having said that, it is certainly NOT all doom and gloom. Well prepared submissions with the right level of detail still result in good commercial approvals however they can take a few more days to get the result.

The more challenging issue is the shortage of good experienced commercial equipment finance credit teams within the primary banks and financiers.

This is a specialist area with specialist skills and in reality we are an ageing population with many of the old school experienced equipment finance analysts having either retired or some years ago became capable equipment finance brokers.

In a world where the vast majority of equipment finance transactions (which by sheer number are under $500,000) are assessed under these matrix programs, little “full assessment” experience is being provided to up and coming credit officers.

As equipment asset values increase, the remaining experienced credit team are increasingly put under pressure which often results in delays on significant submissions or over conditioned approvals to outright declines if being assessed by more junior in experienced credit analysts.

This landscape has further increased the value of capable equipment finance brokers who understand the credit process, recognise the level of information required from the outset, choose the most appropriate lender, communicate in lender terms as well as respectfully but robustly argue the merits and mitigants required to maximise the desired outcome including accelerating the process for the client.

Although the Royal Commission into the banks has had its obvious ramifications, perhaps the most significant affect is the acceleration of the above issues and with recent press confirming that one of the major banks is well on its path to reducing the headcount of its’ employees by a further 6,000 personnel. One can only assume that this area is not going to get better and the advantage of a long-term engagement with a skilled advocate in this space well worth considering. There are plenty of them out there, you just have to choose the right one.

It is no wonder that over 50% of small to medium size businesses engage the services of specialist Equipment Finance Brokers and this number is growing each year.

The Finlease Team is always available on their mobiles, or give us a call on

1800 358 658 and we will connect you to one of our team members.

Mark O’Donoghue, Founder & CEO Finlease

Take a look at our home page to learn more about Finlease and follow our socials.

More News

How Access to Multiple Lenders Fuels Your Business Growth: Why One Bank Isn’t Your Only Option | Finlease

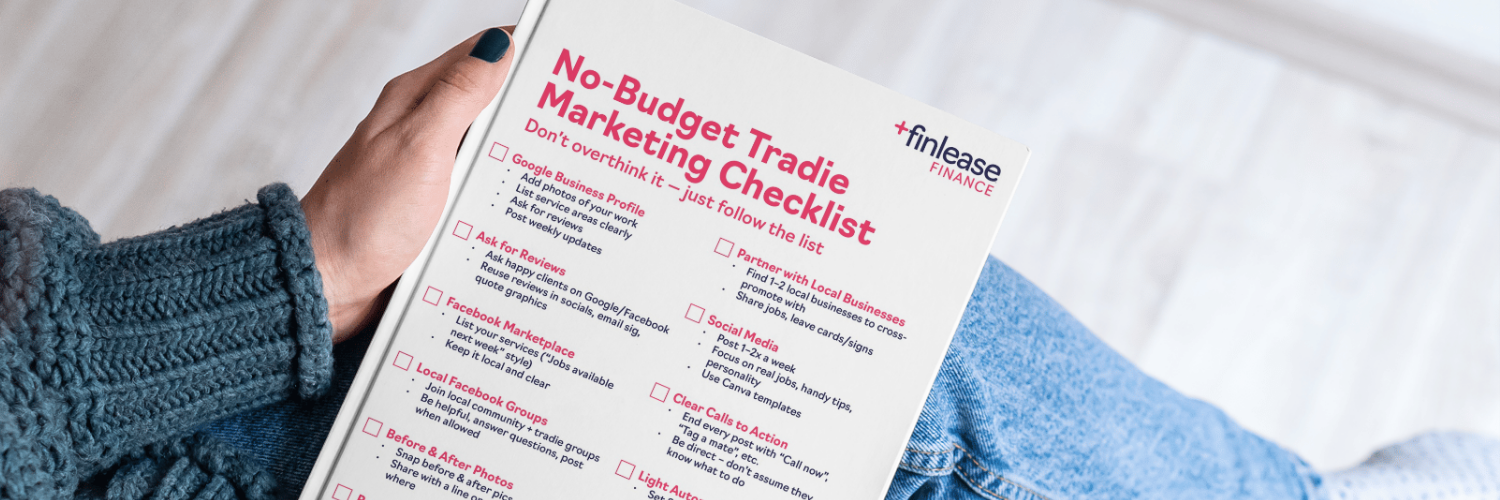

Marketing Ideas for Tradies With No Budget