Insurance Premium Funding

Published

Insurance brokers typically offer Insurance Premium Funding (IPF), which has been around for years.

IPF allows you to streamline your insurance into a single premium and control your payments in one place. Secure optimal coverage, distribute payments over 12 months, regardless of insurer’s typical options, to guarantee suitable protection.

There’s an opportunity for businesses to save money and free up much-needed cashflow, using Insurance Premium Funding. At Finlease, we’ve partnered with a number of major funders to offer business owners very competitive and simple finance solutions for all of your insurance premiums; both cancellable and non-cancellable policies.

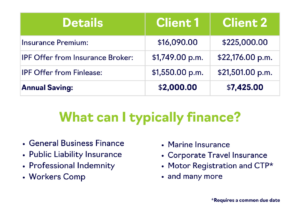

Here’s some recent examples where IPF has shown a saving of around 12% on historic finance costs:

No requirement for financials or personal guarantees for policies up to $250,000*

The process is simple.

All we need is a copy of your insurance policy statement/summary listing all the policies and the annual premiums and we can take it from there. Get in touch with us if you’re interested in spreading the cost of your finance over a 10, 11, or 12 month term, and let us save you some money.

Questions? You can get in touch with us here.

More News

Overcoming Growing Pains: Equipment Finance Strategies for Businesses | Finlease

How Access to Multiple Lenders Fuels Your Business Growth: Why One Bank Isn’t Your Only Option | Finlease