Save Money with a Mortgage Health Check

Published

Considering your home loan is probably the largest debt that you will ever have and for most of us it’s paid in “after tax” dollars, any ongoing savings can really add up. We find ourselves in a peculiar market with some very attractive interest rates being offered especially in the 1 – 3 year fixed rate areas as they are often substantially less than the current variable rates.

Why not do a little research as each $1,000 saved is $1,500 to $1,900 you don’t have to earn. Haven’t got time? Just give us a ring, we can get back to you in a day or so to let you know what is on offer and how much you can potentially save. Often, believe it or not, without having to change lenders. As bad as it sounds, banks are often just like mobile phone companies, they have cheaper plans but don’t bother telling you about them, they are happy for you to pay the higher costs until you ask for the better plan.

Unlike the big banks however, at Finlease we take the time to visit you, understand your situation and assist you in selecting the right financing solution. If you are not satisfied with our solution, simply walk away with no cost. We are delighted to seek approvals as over 85% of them are taken up by clients!

Don’t forget to follow us on Facebook and Instagram for more up-to-date content.

Don’t just take our word for it though, visit product review at http://www.productreview.com.au/p/finlease.html and see what our clients have to say about us!

To speak to one of our home loan experts call 1800 358 658 now!

More News

How Access to Multiple Lenders Fuels Your Business Growth: Why One Bank Isn’t Your Only Option | Finlease

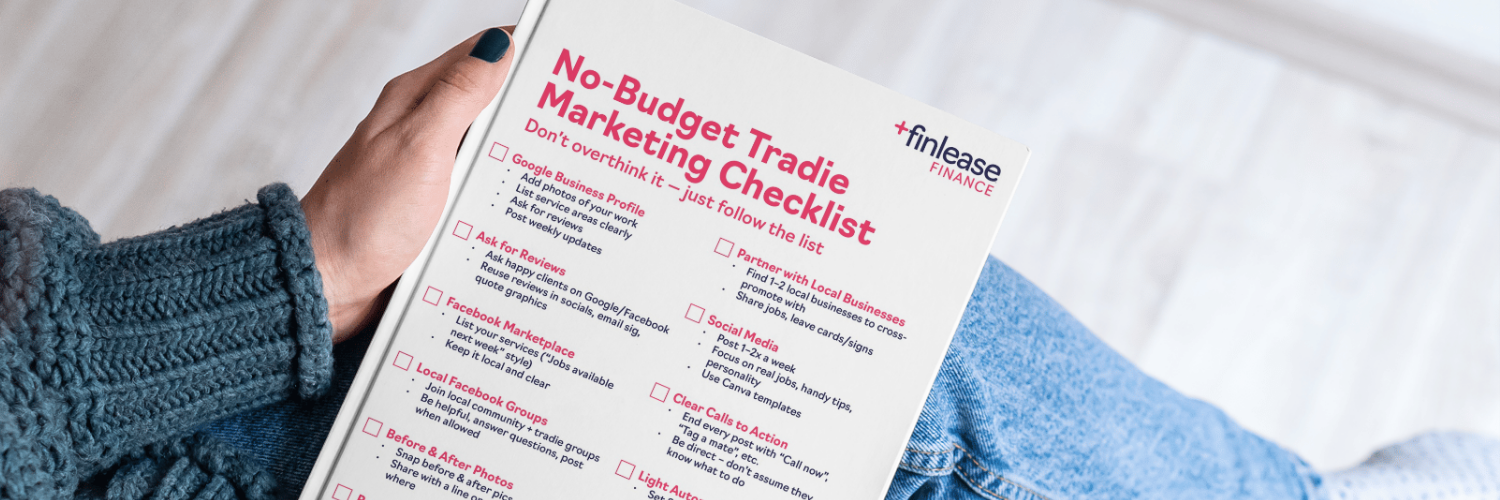

Marketing Ideas for Tradies With No Budget