The Overdraft Alternative

Published

In today’s business environment, access to cheap flexible cash is paramount.

Money (Cash) is just another key component of business, similar to raw materials and labour. It should be accessed at the cheapest possible rate and with the greatest amount of limits available and with flexibility.

Perhaps it is time for owners of small businesses to have a good look at the way they finance their day to day business activities.

In the vast majority of cases, the following statements would be accurate for most privately owned businesses.

- Their present bank overdraft facilities incur interest rates, fees & charges which are significantly higher than “home loan” rates.

- The many cases, these bank overdrafts are secured via mortgages over real estate which have a value well in excess of the debt and despite this, their bank is reluctant to provide a reasonable level of overdraft limit (up to 80% of property value).

- Additionally many companies have had to provide as additional security for their overdraft a fixed and floating charge over their business which was previously referred to as Registered Equitable Mortgage (REM) and now referred to as a General Security Agreement (GSA) despite the significant equity in real estate held by the bank.

Over the past few years, there have been two occurrences, which have led to a unique opportunity for businesses to substantially reduce the costs and constraints in a traditional bank overdraft as well as secure overdraft style facilities which are sufficient to fund the ongoing business.

1. The Real Estate secured loan market has become highly competitive with many NON BANK institutions providing excellent alternatives to the Banks. The facilities now available have become highly flexible with “come and go” facilities similar to an overdraft being arranged for amounts up to 80% of property values, with no cost for un-drawn amounts, no ongoing fees, no requirements for annual reviews & no Charges (GSA) over the business.

2. In many instances the value of real estate owned by private business owners has substantially increased over the past few years, providing a much higher level of security on their original facilities & as such can now secure substantially higher levels of low cost, flexible overdraft style facilities.

Simple real estate secured debt, arranged correctly, is the cheapest, most flexible structure for working capital and far superior to a traditional overdraft.

Mark O’Donoghue, Founder & CEO Finlease

Take a look at our home page to learn more about Finlease and make sure to follow our socials.

More News

How Access to Multiple Lenders Fuels Your Business Growth: Why One Bank Isn’t Your Only Option | Finlease

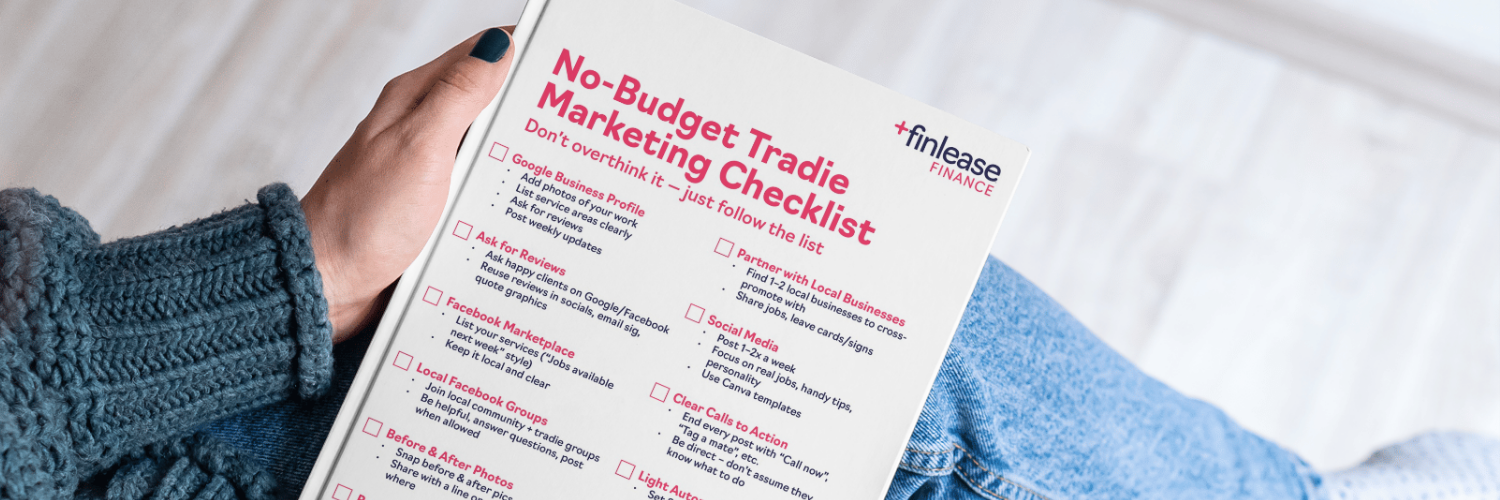

Marketing Ideas for Tradies With No Budget