The Vital PPSR Facts You Should Know | Finlease

Published

If you own equipment, you need to understand some vital facts about PPSR. We’re going to cover 3 key areas:

- Retaining ownership & possession of any equipment in the field.

- Maximising the chance of debts being paid even if your client has collapsed into insolvency.

- Building a defence mechanism against “preferential payment” clawbacks sought by a liquidator on prior payments made to you by a company now in liquidation.

What you should know

Right of ownership can be challenged if PPSR not executed correctly. Retention of an asset (Ownership & Ultimate Retention/Possession) is very reliant on business owners having the right structure including registering their interests correctly on the PPS register (PPSR).

PPSR is a vital tool to recover & keep both money & equipment. PPSR is confusing & often not executed correctly, leaving businesses exposed. There’s a risk of loss of machinery or goods, to the appointed liquidator, alongside potentially wiping out outstanding debts due as well as payments received in the 6 months prior to the client going into liquidation being clawed back through recovery of preferential payments.

Simplifying PPSR: Video Guide

PPSR can be complex, but it’s crucial for protecting your business. That’s why we partnered with PPSAdvisory to create clear, easy-to-follow explainer videos.

Reach out to your Finlease broker who can put you in contact with Simon Read & his team at PPSAdvisory if you would like to know more.

NOTE: there is no economic relationship between Finlease & PPSAdvisory. We are simply providing this information to assist our clients.

More News

How Access to Multiple Lenders Fuels Your Business Growth: Why One Bank Isn’t Your Only Option | Finlease

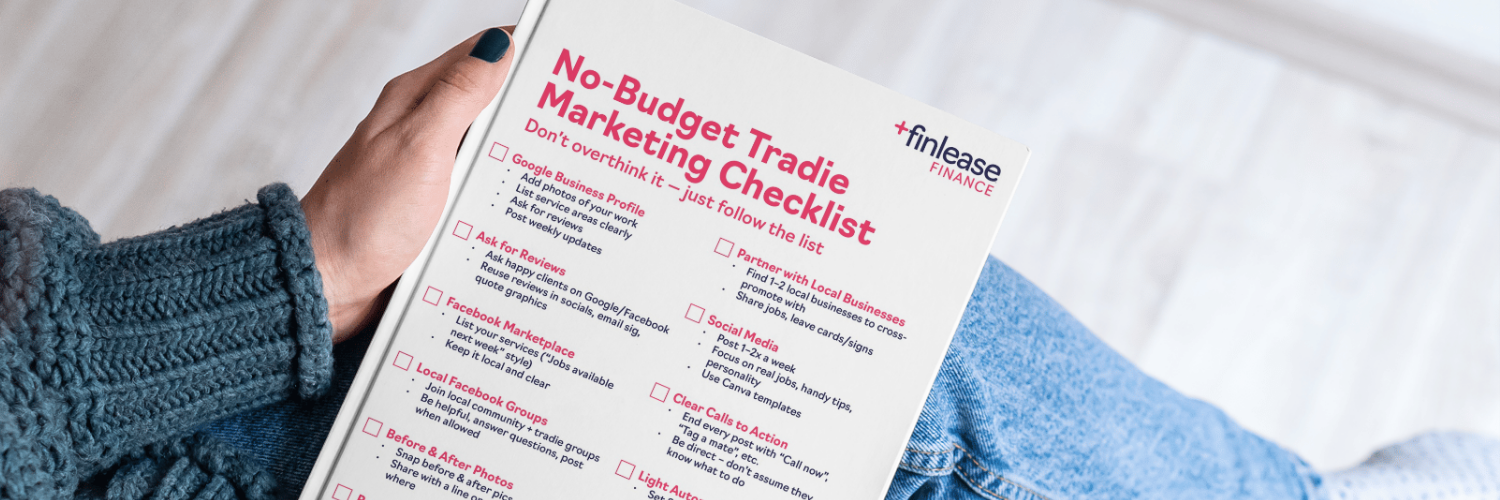

Marketing Ideas for Tradies With No Budget