Why use a broker for your equipment finance?

Published

Why use a broker for your equipment finance?

It’s a common and important question. Over 50% of small businesses (up to $20 million turnover) rely on Equipment Finance Brokers for substantial equipment & vehicle requirements.

Why would they do this?

Having been in the industry for 30 years, I can tell you it’s a combination of a number of factors:

Relationship

The majority of financial brokers are privately owned and operated businesses, just like their clients. This means clients benefit from long-term relationships with brokers, often spanning decades, ensuring familiarity and continuity in their dealings. In a world where Bank Account managers change frequently (every 18 months to 2 years), business owners often prefer long-term relationships. Equipment finance brokers who understand their business can represent them to the market consistently, eliminating the need for repetitive storytelling.

Service

In today’s busy world, business owners do much of their admin work outside of normal business hours. An ability to speak to their broker or banker outside of these hours is crucial. Additionally, business owners have every right to expect that their broker or banker will meet them on site, after hours and where needed on weekends. Brokers dominate equipment finance due to their collaborative approach, exemplifying how small businesses support each other.

Good equipment finance brokers oversee the entire project, handling tasks such as arranging invoices, insurance, documentation, signing, and final settlement on behalf of the client. Done well, the client simply sits back and has it all done for them.

Client retention

For finance brokers, a satisfied long-term client is crucial as their client base is the lifeblood of their business. Incidentally, repeat business for a broker is by far the best business as they already have all their information on file.

A good broker strives to secure long-term clients by utilising the aforementioned reasons to the best of their abilities.

Effectively serving a client spending $500,000 annually on machinery can yield a $10 million value over a 20-year span of loyal partnership.

It’s not rocket science.

Spreading the debt

A capable equipment finance broker secures diverse debt options from multiple competitive underwriters, ensuring broad support for their clients. By doing this, the client will have a broader base from which to expand and some inbuilt competition to ensure the right interest rates and commercial conditions.

Although Brokers earn fees to arrange transactions, a substantial portion comes from volume bonuses and securing discounted rates. Clients often benefit from equivalent or better interest rates compared to their own efforts in the finance community.

The broker provides a hassle-free experience, delivering a competitive facility that feels refreshing compared to banks.

Advocacy

Clients frequently possess extensive knowledge about their specific businesses but may overlook the potential opportunities in equipment financing. There are many instances where an approval provided by the banks is not ideally what the client wanted. The broker’s role is to ensure that any approval is commercial, most closely aligned to what the client wants and not simply what the bank wants.

A skilled broker brings experience, knowledge, skill, and influence to represent clients effectively and negotiate optimal outcomes for them.

The changing market

With the massive increase in behavioural lending for equipment & vehicle finance, many underwriters are now providing automatic “low doc” competitive finance approvals for additional selected equipment and vehicle finance up to $150,000 and up to $500,000 (for replacement equipment, trucks and trailers).

The finance broking community diligently monitors the numerous diverse facilities, offering business owners valuable alternative options to explore.

Selecting the right one

As in any industry, there are good operators and ones not so good. Take the accounting profession, over many years I have heard stories from clients where one accountant has been excellent and another you wouldn’t feed. It’s the same in the finance broking industry, you just need to find the right one (and there are many good operators) and you want to keep them for years.

To find the right one, have a look at what their existing clients are saying. Ask another business owner who they use and why they use them. The best referral is a happy customer.

Just like most small business owners rely on insurance brokers to secure suitable insurance coverage annually, they are increasingly recognizing equipment finance brokers for fulfilling a similar role in equipment financing.

You can get in touch with the Finlease team to learn more about how a broker can assist your business today and into the future.

Mark O’Donoghue, Founder & CEO Finlease

Take a look at our home page to learn more about Finlease and make sure to follow our socials.

More News

How Access to Multiple Lenders Fuels Your Business Growth: Why One Bank Isn’t Your Only Option | Finlease

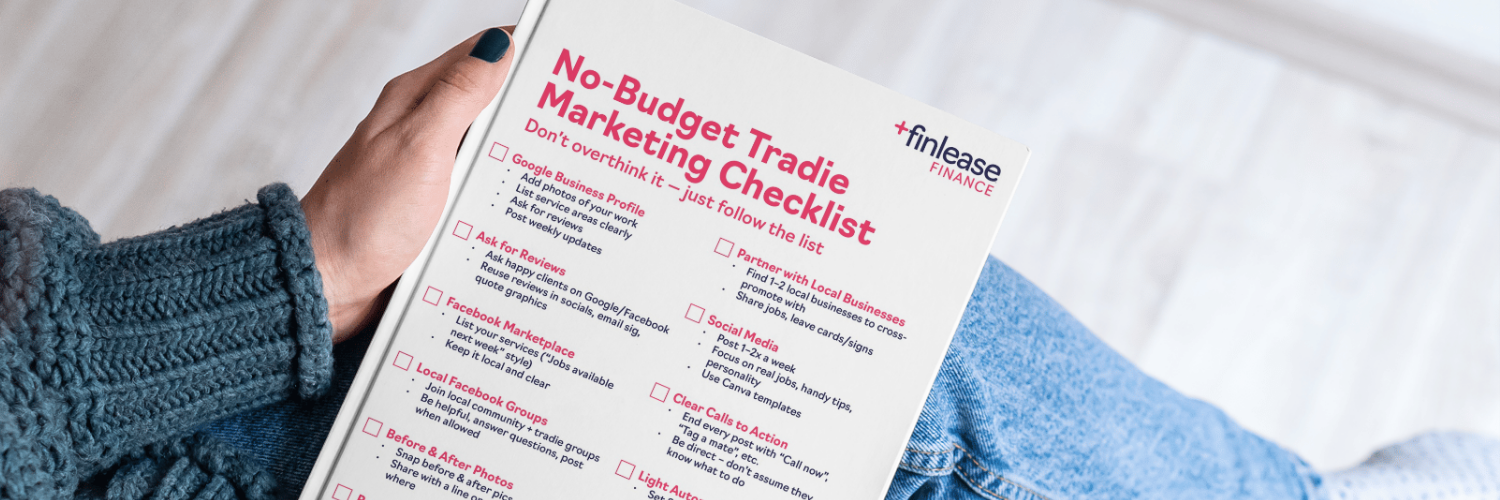

Marketing Ideas for Tradies With No Budget