Taking the stress out of finance

Published

All too often we see companies scrambling at the last minute to put finance facilities in place to pay for machines needed for urgent delivery.

This simply does not need to be the case if companies set up a number of pre-approved Lines of Credit for equipment finance.

These lines of credit are essentially pre-approvals to fund future equipment purchases.

They cost nothing to put in place, can be arranged across a number of lenders (who then can compete for each individual transaction when the time arises).

These pre-approved lines of credit can be set up as bulk facilities which are renewed every year.

There is little to no work to be done by the client if arranged by a capable broker.

Further there is no cost to the client if they are not used so it is advisable to put in place facilities which are more than needed just in case there are unplanned purchases due to machinery burnouts in the forest or other unforeseen events.

As mentioned in previous articles, it is always advisable to finance equipment with one of the many competitive banks and finance companies who are NOT the client’s main bank as this bank will usually have other securities which all get cross collateralised and in doing so unnecessarily “bootstrap” the client when they don’t need to be.

Having equipment finance debt spread across a broader base of financiers who have the equipment as the only hard security, not only keeps the company’s other securities with no additional debt (allowing them to raise more working capital if needed), it forms a broad base of supporting financiers to assist with further expansion. Very similar to the buttress roots of a tree which provides greater stability.

The next 3 months is an ideal time to arrange these pre-approved lines of credit as most companies have completed their 2015 accounts in either management or draft form.

More News

How Access to Multiple Lenders Fuels Your Business Growth: Why One Bank Isn’t Your Only Option | Finlease

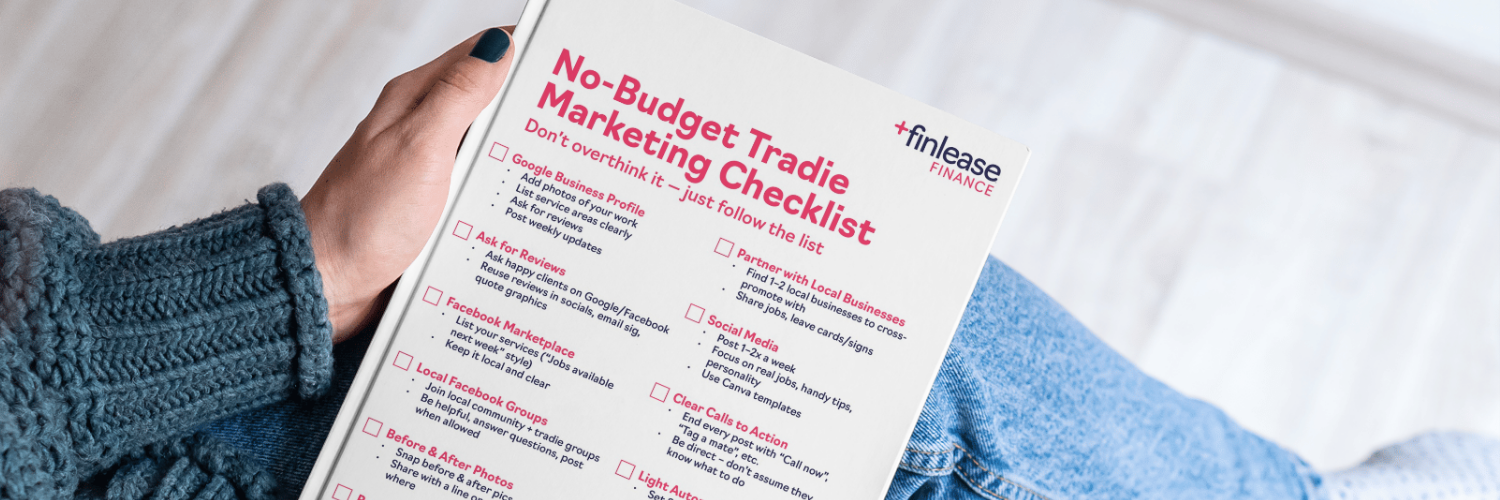

Marketing Ideas for Tradies With No Budget